The market for electric vehicles is about to experience a massive change in the constantly changing automotive sector. Ford and Tesla, two of the world’s leading innovators, have formed a ground-breaking alliance to combine their skills and usher in a new era of sustainable mobility.

The EV scene has been permanently altered as a result of this exhilarating collaboration, and Tesla’s leadership in the electric vehicle market has never been more secure. Prepare to watch history be made as these two powerful driving forces alter the rules of the road and lead us to a greener and more electrified future.

Get ready to see an alliance of power and inventiveness as this powerful pair ushers in a new era of sustainable mobility.

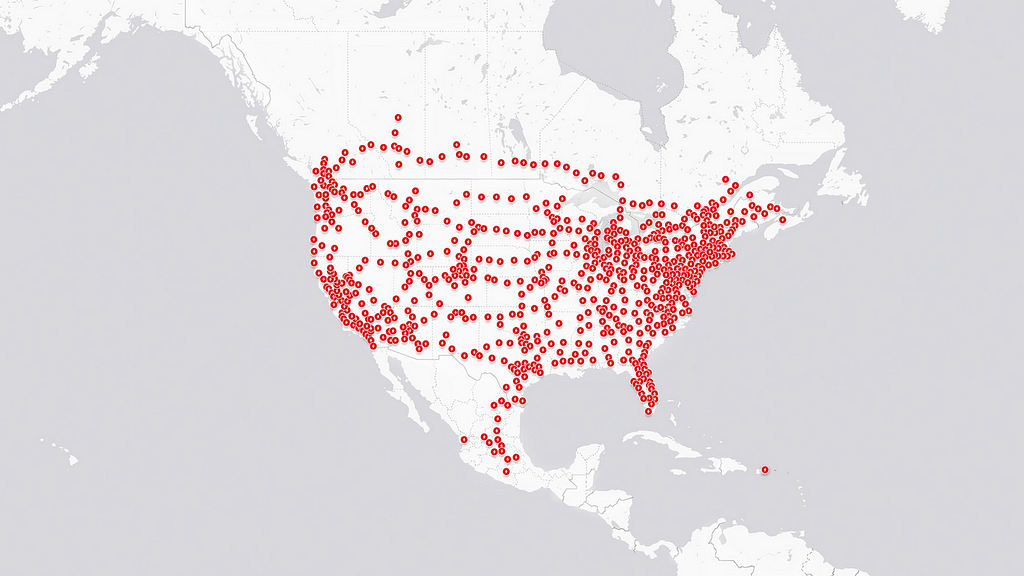

Tesla has previously expressed its intention to allow other electric vehicle owners to use its private charging network. In February, White House officials made an announcement stating that Tesla had committed to making 7,500 of its charging stations accessible to non-Tesla EV drivers by the end of 2024. Previously, Tesla’s charging stations in the United States were primarily designed for and used by Tesla EVs.

According to Tesla’s first-quarter shareholder deck, the company has approximately 45,000 Supercharger connectors worldwide, which are located at 4,947 Supercharger stations. However, specific details about the number of chargers in each country or the revenue generated from these devices are not disclosed by the company. Tesla includes the revenue from its Supercharging stations within the “services and other” segment of its financial reporting.

In the near future, Ford vehicles will gain access to over 12,000 Tesla Superchargers, even before Tesla’s Connectors become available on Ford vehicles. This is significant news for both companies, as it alleviates range anxiety for Ford buyers. Furthermore, Ford’s alignment with Tesla’s standards and technology makes a bold statement, potentially compelling other players in the industry to follow suit to remain relevant.

Tesla has already been opening up its charging network to third-party vehicles, and this announcement further solidifies its leading position. Tesla earns revenue each time a car charges at one of their Superchargers, which can have an adverse impact on competing charging networks that may lose their Ford customers. Elon Musk emphasizes that he does not want to create a closed ecosystem and is instead expanding the charging infrastructure. However, Tesla’s extensive network has the potential to become highly profitable as its dominance grows.

Additionally, Ford is taking steps to produce its own batteries. Jim Farley states that they will not be importing batteries like Tesla has been doing. Tesla does import certain types of batteries, such as LFP or iron-based batteries, while also manufacturing their own 4680 cells in Texas and California and producing 2170 cells in collaboration with Panasonic in Nevada.

Interestingly, Jim Farley openly admits that he believes there isn’t much value Ford can add in the battery space, especially since they will be utilizing Chinese company CATL’s technology to manufacture their own batteries. This mixed strategy may reflect a lack of wholehearted commitment from Ford, which could potentially impact employee morale. In contrast, Tesla has set out to excel in production and bring forth new ideas and technology, aiming to lead the way in developing high-density batteries.

Ford’s ambitions seem relatively modest. While they will gain insights into CATL’s battery manufacturing process, Ford will still need to license and pay for the technology, even though they will fully own their factory in the US and qualify for EV battery tax credits, which is a positive move. CATL specializes in efficient LFP batteries, which will be crucial for Ford, as Jim Farley once again acknowledged that the expensive battery prompted them to “completely re-engineer the vehicle in a way we probably should have done years ago.”

Many of the Tesla-inspired buzzwords and initiatives that Ford is discussing may be aimed at garnering shareholder support and boosting the company’s undervalued stock. However, Ford has set aggressive targets, and failing to meet these numbers could undermine investor confidence.

Ford’s EV Sales Skepticism

CNBC interviewer Phil LeBeau points out that Ford plans to increase their EV sales from 600,000 by the end of this year to 2 million by 2026, but there is considerable skepticism among analysts. This skepticism is justified, as Ford only sold approximately 10,000 EVs in the first quarter based on their quarterly numbers. Achieving the year-end target would require a significant leap.

While Ford has extensive capabilities in vehicle body production, scaling up at such a rapid pace could be hindered by various supply chain challenges, particularly the ongoing chip shortage that affects the entire industry as well as battery pack availability. Even Tesla’s Gigafactory in Texas, which already has a production rate of about 250,000 Model Ys per year, surpassing Ford’s entire EV division, is unlikely to come close to producing 600,000 EVs this year.

Tesla also boasts a more robust EV supply chain compared to Ford. Therefore, these targets set by Ford are extremely ambitious, especially considering that we are already well into the calendar year. It remains to be seen where Ford will stand by the end of the year, not to mention the daunting task of achieving a 50-fold increase in production over the next three years.

Jim Farley counters by highlighting that Ford is entering segments with limited competition, citing the F-150 Lightning pickup truck as an example. However, these larger vehicles require massive batteries that currently do not exist at the scale Ford envisions. In the first quarter, they sold just over 4,000 F-150 Lightning vehicles, which, even when extrapolated annually, represents only a fraction of the approximately 750,000 to 900,000 pickup trucks Ford typically sells.

While Ford has discussed producing its own batteries, these would likely be LFP batteries, which have a lower energy density due to their iron-based composition. Consequently, the battery packs would need to be larger, leading to heavier and less efficient vehicles with reduced range. Alternatively, Ford would need to purchase higher-energy-density batteries from other suppliers, which would entail relinquishing some control over the supply chain. This poses a challenge for Ford as it aims to maintain its F-150 market share during the transition to electric vehicles.

While Jim Farley takes a jab at Tesla’s battery strategy of sourcing LFP batteries from suppliers, this is not the case for the Cybertruck. Tesla has intentionally delayed the Cybertruck’s release to ensure they have sufficient battery supply for its production ramp-up. Tesla Vice President Drew Baglino has confirmed this during multiple Tesla conference calls, emphasizing their commitment to keeping 4680 cell production ahead of the Cybertruck’s demand.

Moreover, Tesla will be manufacturing its own higher-energy-density nickel-based 4680 cells for the Cybertruck at Giga Texas. By utilizing fewer cells per truck, Tesla gains the flexibility to power a greater number of Cybertrucks. Elon Musk has mentioned a target of 250,000 units over the next few years, which, if achieved, would position Tesla as the fourth-largest pickup truck seller in the highly lucrative U.S. pickup truck market, the largest in the world.

Tesla Challenges Ford’s EV Goals

The Cybertruck faces initial challenges in setting up new technology and processes for mass production. However, once production is underway, it should be easier for Tesla to manufacture the vehicle since they do not require a paint shop, which has been a bottleneck for their other vehicles. This eliminates a step in the manufacturing process and streamlines production.

Farley’s claim that Ford is entering markets with limited competition contradicts the reality of the electric pickup truck market. While there is currently no significant competition due to the inability of other manufacturers to ramp up production quickly, Tesla’s track record of rapid scaling is a game-changer that could disrupt the market. Farley’s perspective seems to overlook the potential changes that could occur when a new player with innovative technology, like the Cybertruck, enters the market and pushes existing competitors aside. While Farley expects slow ramp-up times for competitors based on Ford’s own experience, Tesla’s ability to scale quickly is a factor that shouldn’t be underestimated.

Additionally, the assumption that Tesla’s sales of 250,000 Cybertrucks per year would be completely incremental overlooks the impact it could have on the overall pickup truck market. If Cybertruck eats into the market share of existing players, the top 3 manufacturers would experience a rapid decline. Even if Cybertruck sales are partly incremental, diverting potential SUV buyers into the pickup truck segment, could create additional pressure in that market.

Currently, Ford has had to significantly reduce prices on its electric SUVs, while the F-150 Lightning’s pricing remains unaffected due to the absence of competition. If the Cybertruck floods the market, it could trigger a collapse in F-150 pricing. Therefore, it is intriguing that Jim Farley claims Ford is operating in markets with limited competition when reality suggests the opposite. The influence of a single player like Tesla, with price reductions on the Model Y affecting the entire industry and impacting half of Ford’s EV business, demonstrates the significant competition faced by Ford. The Cybertruck is expected to be no different, as it is designed to surpass the F-150 in all aspects. This is concerning for Ford, as the F-150 is currently a major profit center for the company. Regarding Ford Pro’s dominant position in telematics, software, and commercial services, it could potentially differentiate itself and mitigate competition from Tesla over the next few years. However, there are potential risks and challenges that Ford may face in meeting its ambitious EV targets. These include supply chain issues, such as the ongoing shortage of computer chips, which could hinder production ramp-up. Additionally, advancements in battery technology are crucial for Ford’s success, and any delays or shortcomings in this area could impact their ability to meet targets and compete effectively in the EV market.